Our Insurance Solutions

Education-driven coverage for your life, your assets, and your business.

PERSONAL INSURANCE

Protection for your family, your home, and your lifestyle.

Auto & Vehicle

- Personal Auto Insurance

- Classic & Collector Car Programs

- Motorcycle Insurance

- RV & Motorhome Insurance

- ATV & Snowmobile

- Boat & Watercraft Coverage

Home & Property

- Homeowners Insurance

- Condo Insurance

- Tenant/Renters Insurance

- Seasonal & Cottage Insurance

- Rental Property Insurance

- Mobile & Manufactured Home Insurance

- High-Value Home Programs

Lifestyle & Specialty

- Personal Umbrella Liability

- Home-Based Business / Side-Hustle

- Valuables & Collections

- Travel Insurance

COMMERCIAL INSURANCE

Comprehensive risk management for Ontario businesses.

Core Commercial Coverages

- Commercial Property & Equipment

- General Liability & Umbrella

- Commercial Auto & Fleet Insurance

- Directors & Officers (D&O)

- Professional Liability (E&O)

- Cyber Liability & Data Breach Protection

- Business Interruption

- Builders Risk

- Bonding & Surety

- Warehouse, Cargo & Inland Marine

We're Your Partner

Industries We Serve

Tailored coverage and strategic risk management across key Canadian sectors.

Construction & Trades

General contractors, electricians, HVAC, plumbers, landscapers, and more.

Transportation & Logistics

Trucking, fleets, couriers, warehousing, last-mile delivery.

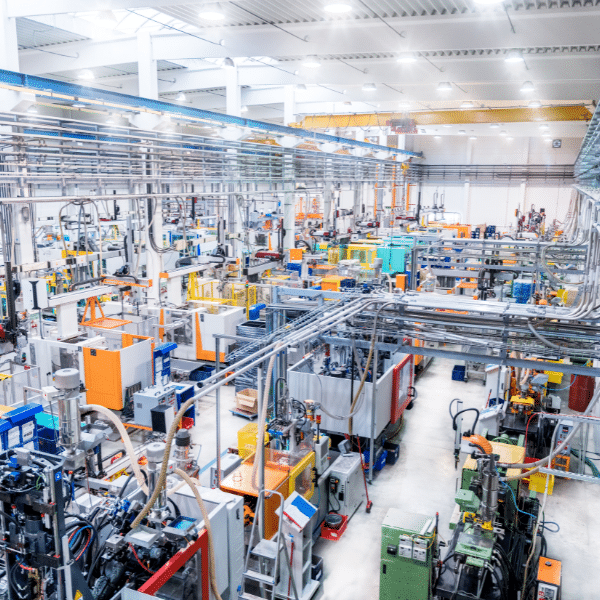

Manufacturing & Industrial

Fabrication, machine shops, production facilities.

Hospitality & Food Service

Restaurants, cafes, breweries, event venues.

Real Estate & Property

Landlords, property managers, REITs, development groups.

Professional Services

Accountants, consultants, architects, engineers.

Healthcare & Wellness

Clinics, dental, pharmacies, fitness and wellness practitioners.

Retail & E-commerce

Brick-and-mortar stores, wholesalers, online sellers.

Agriculture & Agribusiness

Farms, greenhouses, ag-retail, commercial growers.

Non-Profit & Community Organizations

Charities, associations, religious organizations.

Frequently Asked Questions.

Find answers to common questions about home, auto, commercial and specialty insurance.

We provide education-first insurance. That means we explain your options clearly, give you honest recommendations, and build solutions around your needs — not around sales quotas.

Yes. We access leading Canadian insurance markets, giving you multiple competitive options and the ability to choose what suits you best.

Absolutely. We offer complimentary policy reviews to help you understand your coverage, gaps, and opportunities to improve protection.

Yes — we offer comprehensive solutions for individuals, families, entrepreneurs and companies.

We are proudly rooted in Windsor–Essex, serving clients across Ontario.